Director & the Board in Companies Act

- According to the Companies Act of 2013, foreign individuals are not restricted from becoming directors of companies based in India. Foreign individuals or non-resident Indians living outside of India can become executives or non-executive/independent directors of Indian companies, whether listed, unlisted, or private.

- The term “director” in Companies Act 2013 under Section 2 (34) is defined as “a director appointed to the Board of a company”., wherein ―Board of Directors‖ or ―Board‖, in relation to a company, means the collective body of the directors of the company.

DEFINITION OF FOREIGN DIRECTOR

- anybody (including an Indian citizen) who has lived in India for a cumulative duration of less than 182 days in the preceding calendar year will be considered as a foreign national.

- A foreign national is defined in the statute as follows:

A foreign national is defined in the statute as follows: Section 2 (4) – If a person stays in India for more than 182 days during the previous financial year, he is considered a resident of India. There are a few exceptions listed below:

- (a) If a person goes/stays outside India for an uncertain period of time to take up employment, carry on business, or for any other reason, he will be treated as a person resident outside India; or

- (b) If a person who is resident in India goes/stays outside India for any reason, he will be treated as person resident outside India.

Foreign Directors Can Be Appointed As:

- Foreign individuals or non-resident Indians can be appointed as Directors in the Company by following the provisions of the Act 2013 and the Companies (Appointment and Qualifications of Directors) Rules, 2014. In Indian companies, a foreign national may be appointed to the positions of :

(a)Women Director,

(b)Independent Director,

(c) Small Shareholders Director,

(d)Additional Director,

(e)Alternative Director and

(f) Nominee Director

Foreign nationals are not barred from becoming directors of Indian companies . A foreigner or a non-resident Indian can become an executive or a non-executive/independent director of a public or private Indian company.

QUALIFICATION, DISQUALIFICATION AND LIMITS ON THE DIRECTORSHIP QUALIFICATION

Section 162 of the Act specifies the reasons why a person may not be appointed as a director. The Act contains no such provision regarding qualification. However, the following requirements can be listed:

- The individual must be at least eighteen years old.

- Indian or other nationalities are acceptable.

- The individual must have his or her own Digital Signature Certificate (DSC) in order to obtain the Director’s Identification Number (DIN).

- The individual must provide a written declaration stating his willingness to serve as Director and that he is not one of the disqualified members.

- There is no academic qualification required of the individual.

Disqualification of Directors:

- Section 164, provides the conditions under which a person can be disqualified to be appointed a director of a company in three subsections;

- A person shall not be allowed for appointment as a director of a company, under the following conditions;

- He/ she is of unsound mind declared by a competent court;

- If he/ she is an undischarged insolvent;

- In case he/ she has applied to be adjudicated as an insolvent, and his application is pending in the court;

- Furthermore, in case he has been convicted or found guilty by a court for any offence. It may include offences related to moral turpitude or any other offence. Furthermore, if a person has been sentenced in respect thereof to imprisonment for not less than six months and if a period of five years has not elapsed from the date of expiry of the sentence;

- It is provided that if a person has been found guilty of any offence and sentenced for imprisonment for a period of seven years or more, he/ she could not ever be appointed as a director in any company.

- Also, if an order has been passed by a court or tribunal, disqualifying him for appointment as a director, and the order is still in force;

- Moreover, in cases where the director has not paid any calls related to any shares of the company held by him, alone or jointly with other officers, and six months have passed from the last day decided for the payment of the call;

- He has been accused of the offence dealing with related party transactions as per section 188[1] at any time during the last five years;

- He has failed to comply with the provisions of sub-section (1) of section 165.

- Sub section 2

Subsection 2 :

states that a person will be disqualified to be appointed as a director under if he is or has been a director of a company in the following conditions;

- Which has not filed annual returns or financial statements for continuously for any three financial years

- In case the director fails to do the following tasks even after a period of one year;

- Redeem any debentures and pay interest accrued thereon

- Pay any dividend declared

- Repay the deposits accepted along with interest thereon

Appointment of Foreign Director in Private Limited Company

As per the provisions of the Companies Act 2013, a foreigner or Non-Resident Indian (NRI) can be appointed as an executive or a non-executive/independent director in a Private Limited Company provided that there shall be at least one Director who is resident of India. The Companies Act 2013 given permission for foreign nations NRI to become director in Indian Companies. NRI can become an executive or a non-executive/independent director of Indian companies whether public or private. In this article, we had explained procedure to the appointment of director.

Appointment of Foreign Director can be done by two mode.

(a) Appointment by Share Holders

(b) Appointment by Board of Directors

Conditions to Appoint NRI as Director

Companies Act 2013 makes it mandatory that following conditions must be followed to appoint NRI as director in Company registered in India.

- Every person shall hold DIN Director Identification Number

- Persons s not disqualified from becoming a Director

- Need to give consent to act as director in DIR

Key points Appointment of Foreign Director in Private Limited Company

- There are no restrictions in term of residency

- An NRI or Foreign Director can be executive or Non Executive Director.

- A foreigner can be appointed as Whole Time Director or Non Whole Time Director

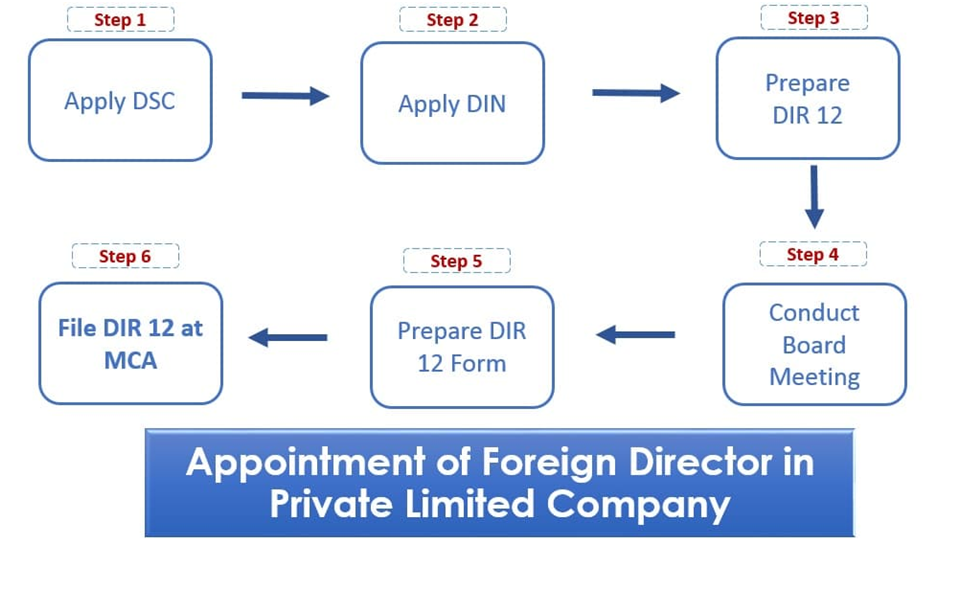

Procedure for Appointment of Foreign Director in Private Limited Company

Step 1 : Apply DSC

To become director in Private Limited Company first step is to apply for Digital Signature of Director. For making necessary filing at MCA DSC is mandatory. List of documents for DSC

- Notarized and Apostilled copy of the passport

- Notarized and Apostilled copy of Driving License

- Passport size photo (Recent)

- Cell & Email ID

Step 2 : Apply DIN For Foreign Director

Director Identification Number is mandatory for becoming director in company. NRI Director need to apply for DIN , by DIR 3 filing. Government fees for DIN registration is Rs. 500/- . Certification From professional CS/CA/CMA is required.

Step 3 : Conduct Board Meeting

Board of directors take collective decisions in favor of company. After receiving request letter from NRI Director to as director board shall conduct a meeting. In meeting board need to pass board resolution to add NRI as director. This documents need to be signed by board and stamp of company required.

Step 4 : Filing of DIR 12 For Appointment

DIR 12 form is required to be filed for appointment of foreign director in Private Limited Company. Content of DIR 12 form are Company details, Date of appointment, Designation, Declaration by first director , Declaration of the appointee director in Form No. DIR-2;